5. vulture hedge funds

THE HEDGE FUNDS (aka Los Buitres, the Vultures) AND BONDHOLDERS

Recommended Resources:

Centro de Periodismo Investigativo Puerto Rico

Hedge Clippers

Ed Morales

Espacio Abiertos

Essential Reading:

Who Owns Puerto Rico’s Debt, Exactly? We’ve Tracked Down 10 of the Biggest Vulture Firms. Financial firms are still fighting to get billions out of the bankrupt island as it tries to rebuild.

By Joel Cintrón Arbasetti and Carla Minet, Centro de Periodismo Investigativo; and Alex V. Hernández and Jessica Stites, In These Times, October 17, 2017

Hedge funds disclose their Puerto Rico debt holdings

By Stephanie Kelly, Reuters, July 26, 2017

The Truly Horrible And Ghastly Mess Of Puerto Rico's Bond Issuance (good background on COFINA) By Tim Worstall, Forbes, May 6, 2017

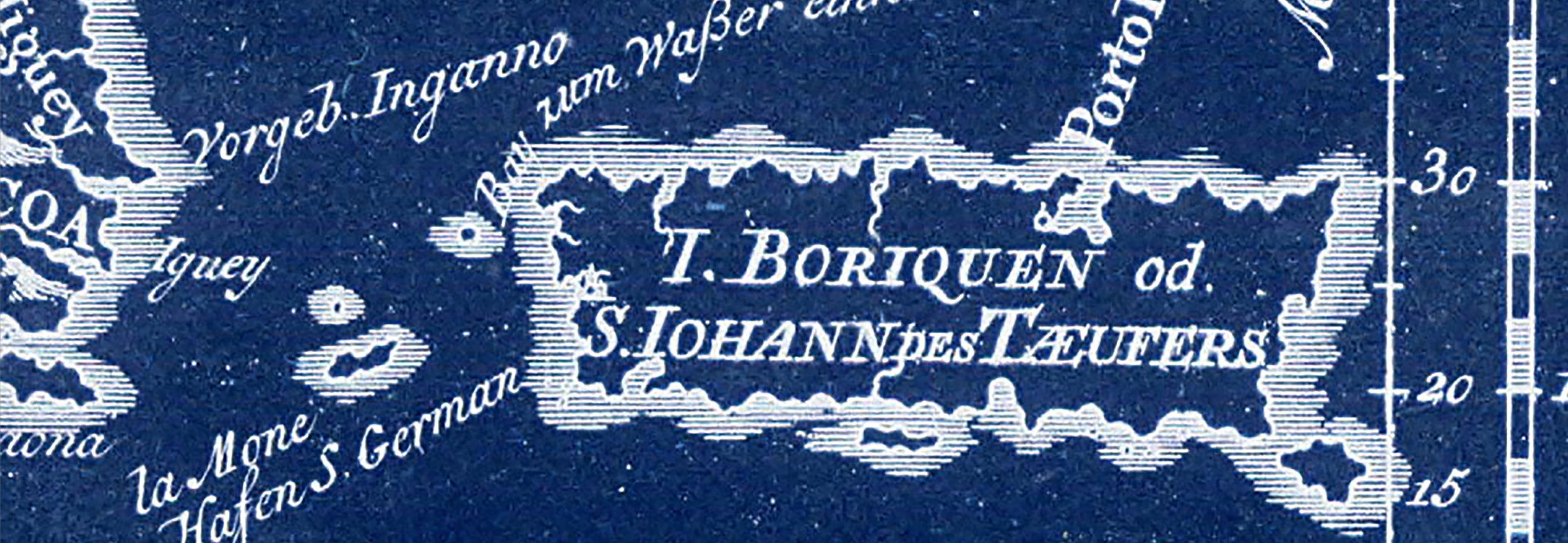

Map of the players and their positions in the Puerto Rico debt game

By Joel Cintrón Arbasetti and Carla Minet, Centro de Periodismo Investigativo, July 23, 2015

“The investment companies have grouped into clans based on the debts they are trying to collect. For example, there are companies that hold GDB bonds, General Obligation bonds (GO’s), the Puerto Rico Sales Tax Financing Corp. (COFINA), or from PREPA.”

“The PREPA Ad Hoc Group One of the clans, the only one that is actually at the negotiating table is the PREPA Ad Hoc Group. The hedge fund members are Angelo Gordon & Company, Blue Mountain Capital, D.E. Shaw Galvanic Portfolios, Knighthead Capital, Marathon Asset Management and Franklin mutual fund. This group hired the Venable Law Firm. Blue Mountain, on its part, also recruited the Gibson Dunn Law Firm. Both law firms have been lobbying against Project HR-870, petitioned by Resident Commissioner Pedro Pierluisi, that seeks to extend Chapter 9 of the Federal Bankruptcy Law to Puerto Rico.”

“Ad Hoc Group of Puerto Rico The Ad Hoc Group of Puerto Rico owns $4.5 billion in GO’s, BGF, and COFINA bonds, according to the financial press. Led by vulture funds Fir Tree Partners, Monarch, Perry Capital, Brigade Capital, Centerbridge Capital, Stone Lion, and Davidson Kempner; this group has been in operation for a year on the island and hired the Robbins, Russell, Englert, Orseck, Untereiner & Sauber law firm.

This law firm has as clients companies that are part Fortune 500 corporations that hold top positions this year, such as Walmart, Exxon Mobil, and Apple. This law firm announced on their Internet page that among its habitual clients are hedge funds companies.

The law firm has represented vulture funds Aurelius Capital, Blue Angel – an affiliate of Davidson Kempner fund and Elliott Management, owned by multimillionaire vulture funds manager Paul Singer, against the government of Argentina, in the debt repayment case against that government to be decided in the New York Court. …

For example, one of the sources of the CPI said that one of the lobbyists that represent the Ad Hoc Group of Puerto Rico is Roberto Prats, former senator and chairman of the Democratic Party in Puerto Rico”

How Hedge and Vulture Funds Have Exploited Puerto Rico’s Debt Crisis

For this island teetering on bankruptcy, debt renegotiation is imminent—but on whose terms

By Ed Morales, The Nation, July 21, 2015

Out in the open, hedge funds in Puerto Rico

By Joel Cintrón Arbasetti and Carla Minet, Centro de Periodismo Investigativo, July 14, 2015

“And who are the lobbyists?"

“At this moment, I can’t remember who they came with. They have come with (Kenneth) McClintock, with Roberto Pratts (sic), but the Ad Hoc Group has not come with any of them. It has come with someone but I can’t remember right now…””

(Just so you understand the local corruption properly, the former head of the Puerto Rico Democratic Party was/is a lobbyist for the Ad Hoc Group, who was suing Puerto Rico. Roberto Prats is considering a run for PR governor in 2020. Ugh.)

A BATTLE OF BILLIONAIRES

Unanswered Questions:

How do the bondholders rate in hierarchy against island pension obligations?

Which of the bondholders has the most legitimate claim of getting paid first and how much?

How do bondholders rate in hierarchy against funding of essential island services, which have not been defined?

Why hasn’t an independent, forensic audit of the debt been completed?

COFINA senior bonds vs COFINA subordinate bonds - how much, if anything are holders of COFINA subordinate bondholders owed?

_____________

1. Autonomy Capital (General Obligation Bondholders)

see Who Owns Puerto Rico’s Debt, Exactly?

_____________

2. Seth Klarman / Baupost Group / Decagon Holdings

(COFINA Bondholder, both Senior and Subordinate)

How Hedge Funds Hide Pt 1

By Michelle Celarier, Institutional Investor, April 17, 2018

““Klarman has cultivated an image as a moral and principled person, which is appealing to those who are more socially responsible investors,” notes Stephen Lerner, a labor strategist and fellow at Georgetown University’s Kalmanovitz Initiative for Labor and the Working Poor who is working with activists seeking to cancel Puerto Rico’s debt. But Lerner isn’t convinced. “It’s disgusting that people like Seth Klarman can hide how they are pillaging countries around the world, taking advantage of people — and it’s even worse when they try to come off as good guys.””

When Hedge Funds Hide Pt 2

Did hedge fund Baupost set up opaque investment vehicles to shield its prestigious clients from headline risk?

By Michelle Celarier, Institutional Investor, April 18, 2018

“Hedge funds, it turned out, had gobbled up Puerto Rico debt assuming it was a sure thing. Their reasoning was that, unlike other issuers of municipal debt, under U.S. law Puerto Rico couldn’t file for bankruptcy. DCI Group, the same lobbying group that had worked for Singer and other Argentina bondholders, fought hard to keep it that way.”

“Seth Klarman is a particularly egregious actor in the Puerto Rican economic crisis due to his decision to use an elaborate network of shell companies in order to keep the public, and presumably investors, from knowing about his dealings on the island . . . the company’s extreme opacity with respect to these investments is unacceptable.”

Seth Klarman Little Sis profile Klarman is on the board of the American Enterprise Institute. Andrew Biggs, one of the Junta members, is also from the American Enterprise Institute (AEI).

Report No. 54 Hurricane Harvard and the Damage Done to Puerto Rico: How the University’s Endowment Investment Harms the Island Hedge Clippers, January 23, 2018

“Harvard is heavily invested in the Baupost Group, one of the biggest speculators in Puerto Rican debt with $931 million in bonds.[5] Baupost, a Boston-based hedge fund run by billionaire Seth Klarman, bought the debt at depressed prices in the hopes of scoring higher-than-expected payouts. Along with other vulture funds, it is waging an aggressive campaign to force Puerto Rico to pay creditors – rather than pay for basic services or vital infrastructure. Even after Hurricane Maria struck the island, Klarman has rejected calls to cancel the debt.

Harvard has an astonishingly large amount of money – nearly $2 billion – invested with Baupost.[8] It appears to be the university’s largest outside investment and represents an unusually large percentage of the endowment, over 5%. Through its investment in Baupost, Harvard could have an interest in tens of millions of dollars in Puerto Rican debt. Additionally, as one of Baupost’s biggest investors, probably its biggest, the university has significant sway over the hedge fund.

Furthermore, Baupost’s CEO Seth Klarman is a prominent donor to Harvard, which may have shaped the university’s decision to invest with his fund and raises an apparent conflict of interest.”

Protesters Call on Harvard to Divest from Puerto Rican Debt

By William L. Wang, Harvard Crimson, January 25, 2018

Harvard’s Endowment is Profiting from Puerto Rico’s Debt as the Island’s School’s Face Crippling Cuts

By David Dayen, The Intercept, January 25 2018

Debt Vultures Behind Puerto Rico Austerity Are Also Fueling Climate Change

By Guest • Saturday, November 11, 2017

Yale linked to Puerto Rico creditor

By Jingyi Cui, Yale Daily News, Oct 23, 2017

Letter to University Endowments Regarding Baupost Group Puerto Rico Debt

Hedge Clippers, October 23, 2017

Residents rally against Boston-based Puerto Rico debt holder

By Haley Lerner, The Daily Free Press, October 22, 2017

Hedge-fund billionaire Klarman says Puerto Rico should pay its debts

By Tae Kim, CNBC, 20 Oct 2017

Exclusive: Baupost's Klarman resists calls to wipe out Puerto Rico debt

By Svea Herbst-Bayliss, Reuters, October 18, 2017

Hedge Fund Run by Seth Klarman ’79 Owns Nearly $1 Billion in Puerto Rican Debt

By Nicholas Bogel-Burroughs and Alisha Gupta, The Cornell Daily Sun, October 12, 2017

How Seth Klarman, One of Puerto Rico’s Biggest Debt Vultures, Was Exposed

by Kevin Connor, Little Sis, October 10, 2017

"LittleSis worked with the Intercept to unmask Baupost and Klarman, who clearly would have preferred to remain anonymous. Here’s a bit more context on the research process that eventually exposed them."

Jewish Billionaire Seth Klarman's Fund Revealed as Secret Holder of $1 Billion in Puerto Rico Debt

Haaretz, Oct 09, 2017 (this is the title Israeli newspaper gave this article, not me)

“Klarman, chairman of the board and capital partner at The Times of Israel, regularly contributed through his foundation, the Klarman Family Foundation, to the Boston-based NGO, before and after The Times of Israel was established in 2012. Klarman is the sole donor to the Klarman Family Foundation.

Klarman is an avid supporter of Israel and is a major donor through his foundation to Birthright-Taglit, which received $1.5 million in 2014 alone. His foundation also supports pro-Israel advocacy organizations such as The Israel Project ($400,000 in 2014), The David Project ($300,000 in 2014) and others.”

The Hedge Funder Who Secretly Bought $1 Billion in Puerto Rican Debt Is Also a Secret Backer of Charter Schools Billionaire Seth Klarman is one of many investors not only profiting from Puerto Rico’s debt crisis but also perpetuating it.

By Jeremy Mohler, Alternet, October 6, 2017

“First, when officials in Massachusetts forced a secretive political organization to reveal its donors, Klarman’s name topped the list. Of the more than $15 million Families for Excellent Schools spent pushing last November’s failed ballot initiative to increase the number of the state’s charter schools, $3.3 million came from Klarman, the most from any single individual. Partners at Klarman’s hedge fund the Baupost Group chipped in another $376,000, joining a who’s who of billionaires and private investors, including Alice Walton of Walmart fame and multiple partners from Mitt Romney’s former firm Bain Capital.”

We Can Finally Identify One of the Largest Holders of Puerto Rican Debt

By David Dayen, The Intercept, October 3 2017

Times of Israel Cofounder Gave $1.5 Million to Right-wing Media Watchdog That Routinely Goes After News Outlets Seth Klarman's foundation gave $200,000 to Camera in 2012 - the same year Times of Israel was launched. That donation was one of at least nine annual contributions to Camera, financial reports reveal.

By Uri Blau, Haaretz, Sep 05, 2016

Jewish Billionaire Seth Klarman Joins Wealthy Republicans Supporting Clinton Disillusioned by Trump, some Republicans are courting prominent peers to join them in backing his Democratic rival. (this is the title Israeli newspaper gave the article, not me)

By Olivia Oran and Amanda Becker Haaretz, Aug 04, 2016

_____________

3. Canyon Capital Advisors LLC

Hedge fund founded by Joshua S. Friedman and Mitchell R. Julis in 1990 located in Los Angeles, California.

Does Canyon Capital Have a Conflict in its Puerto Rico-Fueled Proxy Fight with AMBAC?

By Chris Versace, The Street, Apr 18, 2016

The trajectory of hedge funds found in Puerto Rico

By Joel Cintrón Arbasetti, CPIPR, July 15, 2015

"Canyon Capital and its affiliates manage more than $23 billion in funds and have more than 200 employees, including 100 investors in its team. The co-founder of Canyon Capital, Mitchell Julis, has been number 25 in a list of the 50 richest hedge fund directors in the Hedge Fund Journal. His first job after graduating from Harvard Law School was as a bankruptcy attorney in New York. Afterwards, he worked with economist Michael Milken, known as “the father of junk bonds.” In 1990, he founded Canyon Capital with Joshua Friedman, an ex-banker at Goldman Sachs, who also appears on the list of the richest hedge fund directors. Both of them made $150 million in 2013, according to Forbes. In 2011, Canyon joined Agassi Venture to invest in the construction of charter schools in the United States; an investment that they expect will generate between $300 million and $50 million in profits, and opened their first school in 2012."

Puerto Rico’s $72 Billion Mess Reunites Lehman Foes

By Laura J. Keller, Bloomberg, June 1, 2015

10 Youngest Hedge Fund Billionaires - Insider Monkey

By Meena Krishnamsetty, July 31, 2014

"Joshua S. Friedman started Canyon Partners with another former Drexel Burnham trader, Mitchell Julis in 1990. Friedman went to Drexel after a stint at, you guessed it, Goldman Sachs."

Marco Rubio receives money from hedge funds, then opposes Chapter 9 bankruptcy for Puerto Rico By Nelson Denis

“Rubio also failed to mention the names of the people, and the hedge funds, that are donating to his campaign and screwing Puerto Rico.

Here are some of them:

Canyon Capital Partners / Andrew Herenstein

Apollo Global Management / Peter Copses

Monarch Alternative Capital / Joshua Friedman”

_____________

4. Monarch Alternative Capital (general-obligation bondholders)

Andrew Herenstein - Ted Cruz & Marco Rubio donor

Rubio’s neocon-establishment team bolstered by ‘Zionaire’ hedgefunder who denies existence of Palestine

By Philip Weiss, Mondoweiss, December 21, 2015

Inside the Billion-Dollar Battle for Puerto Rico’s Future

By Jonathan Mahler and Nicholas Confessore, NYT, Dec 19, 2015

“Early this year, with Puerto Rico’s economic outlook darkening, the island’s nonvoting member of the House of Representatives, Pedro R. Pierluisi, made what he thought was a modest proposal. He introduced a bill that would change federal law to allow Puerto Rico’s struggling municipalities and public corporations, such as the island’s power authority, to declare bankruptcy. It would affect only about a third of the island’s debt, Mr. Pierluisi told Republican colleagues in Congress. It would also give Puerto Rico the same right as most states and leverage against creditors — so-called Chapter 9 bankruptcy protection. And it would cost taxpayers nothing.”

“In September, on the eve of a campaign visit to Puerto Rico, Mr. Rubio abandoned the idea (of Pierluisi’s bankruptcy bill) entirely In an essay on the website Medium and in Puerto Rico’s largest daily newspaper, he wrote that bankruptcy should be considered only as a “last resort” if the island first took “significant steps to fix its budget and economic mess,” echoing a refrain among Republicans in Congress. Mr. Rubio’s move was welcome news for bondholders, some of whom have supported his presidential campaign. Monarch’s founder, Andrew Herenstein, co-hosted two fund-raisers for Mr. Rubio’s presidential bid, one over the summer in the Hamptons, the other in Manhattan in October. A spokesman for Mr. Herenstein declined to comment.”

Rubio received donations from execs of hedge funds invested in Puerto Rican debt before opposing bankruptcy

By Casey Tolan, Splinter News, November 3, 2015

After Rubio made his announcement, Herenstein co-hosted another fundraiser.

Monarch's Andrew Herenstein says recommends buying Puerto Rican debt

Reuters, October 14, 2015

Shadowy saviours of the Co-op - Hedge funds, renowned for their relentless pursuit of profit, now own 70 per cent of the beleaguered bank – and that hands its customers a huge dilemma

By Jim Armitage, The Independent, November 5, 2013

____________________

5. Goldentree Asset Management

____________________

6. Aurelius Capital (general-obligation bondholder)

Mark Brodsky, a lawyer formerly employed by Paul Singer’s (aka The Vulture) of Elliott Associates

Puerto Rico creditor Aurelius asks U.S. judge to throw out bankruptcy

By Nick Brown, Reuters, January 10, 2018

“Aurelius Capital Management, a major Puerto Rico bondholder, asked a federal judge on Wednesday to throw out the U.S. territory’s historic bankruptcy, challenging the constitutionality of the board overseeing the island’s finances. At a hearing in federal court in New York, Aurelius told U.S. District Court Judge Laura Taylor Swain that Puerto Rico’s oversight board was appointed by the U.S. Congress in violation of the Constitution’s appointments clause, which governs how certain public officials are designated.

“Congress can go back and do this right,” Aurelius lawyer and former U.S. Solicitor General Theodore Olson said. “The president can make new appointments.””

Aurelius hedge fund seeks to toss Puerto Rico's bankruptcy filing

By Tom Hals, Reuters, August 7, 2017

“Puerto Rico’s bankruptcy, aimed at restructuring $72 billion of debt, violates the U.S. Constitution and should be dismissed, the Aurelius Capital Management hedge fund said in a court filing on Monday.

The U.S. commonwealth’s federally appointed oversight board initiated its debt-cutting proceeding in May under a law known as PROMESA. Puerto Rico is barred from traditional municipal bankruptcy protection under Chapter 9 of the U.S. code.

Affiliates of Aurelius argued in court papers that the creation of the oversight board violated the U.S. Constitution’s Appointments Clause. Aurelius said board members answer only to the U.S. president, yet their appointments were never confirmed by the Senate. Six of seven members were essentially hand-picked by Congress, violating the principle of the separation of powers, the hedge fund said.

The fund, known for its years-long battle with Argentina over its defaulted debt, seeks to bar the oversight board from operating until it has been validly constituted.”

“Aurelius holds roughly $468 million worth of debt guaranteed by Puerto Rico’s constitution. The hedge fund, run by Mark Brodsky, is known for buying distressed debt and pursuing aggressive litigation tactics to boost recoveries. In the Argentina case, the fund participated in numerous legal actions, including an unsuccessful attempt to attach Argentine pension and retirement funds located in U.S. banks. The firm was one of many parties that settled with Argentina in 2016.”

Aurelius Capital Sues to Dismiss (Our Colony) Puerto Rico’s Bankruptcy Case Based on the Appointments Clause

By Lambert Strether, Naked Capitalism, November 26, 2017

“Aurelius Capital is a hedge fund chaired by Mark Brodsky, a lawyer formerly employed by Paul Singer’s Elliott Associates (yes, that Paul Singer). Aurelius, bless their hearts, is trying avoid taking a haircut on some Puerto Rican bonds they vultured, but in the process the extremely smart lawyers they’ve hired (chief among them Theodore B. Olson, of Gibson, Dunn & Crutcher) have come up with some amazing arguments with broad potential implications, regarding both the appointments clause and Puerto Rico’s colonial status.”

[COLUMN] Et tu, Ricky and José?

By John Mudd, Caribbean Business, December 20, 2017

“Most Puerto Ricans are familiar with the “Insular Cases,” a series of decisions by the U.S. Supreme Court that say Congress may do with Puerto Rico as it pleases, given its territorial status, with the exception of alienating fundamental rights. The most ubiquitous of these decisions is the 1901 Downes v. Bidwell decision, which is now at the center of the legal theory being used by Gov. Rosselló and the Fiscal Oversight & Management Board to defend Promesa, the P.R. Oversight, Management & Economic Stability Act, against claims by both creditors and a local union that the appointment of the members to the Board violates the Appointments Clause of the U.S. Constitution.

For context, all parties to the Appointments Clause litigation agree on one point: The only thing at issue in that litigation is whether, as the challengers claim, the President should have a free hand to appoint the Board members subject to Senate confirmation, or whether, instead, the incumbent Board members, who were effectively picked by four members of Congress, should be allowed to keep their positions and be spared Senate confirmation. Neither asset manager Aurelius nor Utier, the Irrigation & Electrical Workers Union, have sought to throw out Promesa or change any of its provisions other than the one dealing with how Board members are selected, and even then, they just suggest minor surgery on that one.

The Downes v. Bidwell decision is not a simple business decision handed down by the U.S. Supreme Court at the turn of the century; it is a pinnacle moment in U.S. legal history that provides a picture-perfect example of our nation’s past rooted in racism and colonialism. Let’s put this into context: Downes, which was written by the same Court that upheld racial segregation in Plessy v. Ferguson, states that “if the conquered are a fierce, savage, and restless people, [Congress] may […] govern them with a tighter rein, so as to curb their ‘impetuosity, and to keep them under subjection.’” The decision gives Congress the right to create such organizations as “it may deem best,” and “to deprive such territory of representative government if it is considered just to do so, and to change such local governments at [its] discretion.””

See Insular Cases post for more info.

Rubio’s Billionaire wins ransom from Argentina (Paul Singer)

By Greg Palast, February 29, 2016 [Greg Palast has investigated Paul "The Vulture" Singer for BBC TV and The Guardian for the last 9 years.]

"Paul Singer, known as The Vulture, won a $4.65 billion payment from Argentina — nearly ONE HUNDRED TIMES his "investment" of $50 million in old Argentina bonds. It was, in finance speak, the most successful "vulture attack" ever."

_____________

OTHER HEDGE FUNDS PREVIOUSLY MENTIONED:

Marathon Asset Management focused on “opportunistic investing”

“Marathon Asset Management is one of the companies accused of threatening to block the European attempt to save Greece from defaulting unless they are guaranteed a significant payout.

This firm manages $10 billion in capital and has been purchasing bonds of Puerto Rico’s debt since 2013. Bruce Richard, director of Marathon, said in June that PREPA could avoid restructuring if it accepted a plan that included an injection of $2 billion to stabilize the public corporation. In 2013, Richard told Bloomberg that, “Marathon maintains the position that PREPA does not need restructuring, that it is a corporation with valuable assets if it was slightly more efficient and built its own power plants on the island.” He also mentioned that it had been a good idea to invest in PREPA. Marathon is of one the hedge fund companies accused of impeding the financial rescue of Greece in 2012.”

Bruce Jeffrey Richards, Bloomberg profile

Marathon's Bruce Richards says distressed cycle 'pushed out'

By Lawrence Delevingne, Bloomberg, November 14, 2016

"Bruce Richards, chairman and chief executive officer of Marathon Asset Management, said the positive effects of U.S. President-elect Donald Trump’s economic plans would delay the opportunity to buy cheap distressed assets in the United States."

Marathon Sees Prepa Debt Among ‘Best Ideas’ in Gundlach Echo

Marathon Asset Management’s chief executive officer said debt of Puerto Rico’s public power utility is among the distressed-debt firm’s best investments.

By Laura J. Keller, Bloomberg, May 6, 2015

Vulture funds have Puerto Rico cornered

By Joel Cintrón Arbasetti, CPIPR, April 9, 2015

_____________

Appaloosa Management LP

Appaloosa Management is an American hedge fund founded in 1993 by David Tepper and Jack Walton specializing in distressed debt.

David Tepper, the billionaire who supports tenure reform and charter schools, supported the 2016 Jeb Bush presidential campaign

Hedge Funds Fight to Save Puerto Rico Investments

By Michael Corkery and Alexandra Stevenson, NYT, June 30, 2015

Let Us Help You, Hedge Funds Tell Puerto Rico

By Michael Corkery, NYT, September 12, 2014

Hedgepapers No. 17 - Hedge Fund Vultures in Puerto Rico

By Hedge Clippers, 10 Jul 2015

"Hedge funds and billionaire hedge fund managers have swooped into Puerto Rico during a fast-moving economic crisis to prey on the vulnerable island. Several groups of hedge funds and billionaire hedge fund managers have bought up large chunks of Puerto Rican debt at discounts, pushed the island to borrow more, and are driving towards devastating austerity measures. At the same time, they are also using the island as a tax haven.

The hedge fund billionaires active in the Puerto Rican debt crisis are the same characters pushing austerity and privatization in New York and across America.

They are fueling inequality by demanding low taxes on wealthy investors, higher taxes on working people, lower wages, harsh service cuts and privatization of public schools.

Hedge Clippers provides this “scorecard” of 13 hedge funds and top billionaire hedge fund managers active in the Puerto Rican debt crisis to help the public understand exactly how hedge funds are hurting Puerto Rico, New York and America in their effort to extract massive profits from human misery."

"In Argentina, for instance, a vulture fund owned by Paul Singer is in line for an estimated 1380% return on its initial investment.[5] All told, Singer expects a $1.4 billion payment from Argentina on debt his funds bought for pennies on the dollar.[6] One of the key firms involved in that trade, Mark Brodsky’s Aurelius Capital, is also active in Puerto Rico."

_____________

Paulson and Co Inc

Paulson & Co.

“the firm had a relatively low profile on Wall Street until its hugely successful bet against the subprime mortgage market in 2007.”

The Mafia Godfather of Puerto Rico (John Paulson)

By Nelson Denis, War Against All Puerto Ricans blog. 3/22/2016

Puerto Rico woos US investors with huge tax breaks as locals fund debt crisis

By Rupert Neate, The Guardian, 14 Feb 2016

“Schools and hospitals are at breaking point but the governor is offering hedge fund billionaires ‘unparalleled incentives’ to move to the Caribbean territory”

“At an investment conference held a short walk from the soft sands of Condado, east of old San Juan, Paulson, most famous for making a $4bn killing on the collapse of the sub-prime mortgage market, pitched Puerto Rico as a new tax haven with “the potential to become the “Singapore of the Caribbean.””

John Paulson: Why I put billions in Puerto Rico

By Heather Long, CNN Money, February 12, 2016

John Paulson Says He's Still Considering Move to Puerto Rico

By Michelle Kaske and Alexander Lopez, Bloomberg, February 11, 2016

“You can minimize your taxes in Puerto Rico in ways that you can’t do anywhere else in the world,”

Queens-born John Paulson makes fortune on home foreclosures

By Dave Goldiner Wednesday, NY Daily News, January 16, 2008

_____________

Blue Mountain Capital Management

https://www.vamos4pr.org/resources good starter video

Repiten personajes en las crisis de Puerto Rico y otras jurisdicciones

Por José A. Delgado, El Nuevo Día, 4 de mayo de 2016

on Blue Mountain Hedge Capital

(Republican ex-Congressman Connie Mack from Florida lobbies for hedge fund firms involved in Puerto Rico debt, many of the same firms involved in Argentina's debt.)

"Uno de ellos ha sido el excongresista republicano Connie Mack (Florida), quien por medio de sus empresas de cabildeo Mack Strategies y Liberty International Group ha sido cabildero de firmas de inversiones vinculadas a las crisis de deuda de Puerto Rico y Argentina.... Tras salir de su puesto, por medio de Mack Strategies, el exlegislador se convirtió en cabildero del grupo American Task Force Argentina. En esa tarea trabajó de cerca con la firma de relaciones públicas DCI, que en las controversias con Puerto Rico ha representado al antiguo banco Doral y a la firma de inversiones Blue Mountain."

_____________

Perry Capital LLC

Third Point

Fir Tree Partners

Knighthead Capital Management

Fortress Management

Och-Ziff Capital Management Group

Davidson Kempner Capital

Redwood Capital

Centerbridge Capital

Scoggin Capital

Avenue Capital Group

Brigade Capital Group

DoubleLine Capital

Stone Lion Capital Partners

Maglan Capital

Highbridge Capital Management

Apollo

Schoenfield Asset Management

Arrowgrass Capital Partners

Fundamental Advisors

Meehan Combs

Candlewood Investment Group

Angelo Gordon and Co.

Sound Point

Carmel Asset Management

D.E. Shaw Galvanis

Pine River Capital Management